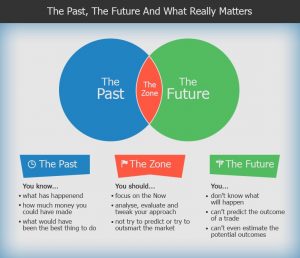

Regretting the past and seeing what you should have done, or worrying about the future and not knowing what will happen next are the two fundamental problems a trader deals with every day. But it goes much deeper and how you handle your past trading experiences and how you think about the future influences your trading in ways most traders are not even aware of.

Below explains how your trading environment influences your trading decisions and how to avoid the most common and most expensive mistakes.

The Past – the emotional baggage of a trader

After closing a trade and watching what happens afterwards, it becomes obvious what you should have done and how much money you could have made. This can lead to a lot of pain and emotional challenges. But the real problem is when the pain of hindsight-knowledge influences your future trading decisions.

Traders who closed trades too early and see that they could have made more money are more likely to jump right back in, violate their rules and revenge-trade. Traders who see that by using a wider stop loss they could have avoided the loss, start seeing their stop as a thing that works against them and might even stop using them all together. Using a bigger position size to make up for past losses, or reducing your position size after a loss because of fear is also something that has to be avoided.

If you find yourself among the description, there are a few things you can do to avoid the most common mistakes:

First, you have to be aware of your language. Using words such as ‘would’, ‘should’ or ‘could’ signal that you are making assumptions based on hindsight knowledge. Second, separate yourself from your trading platform after closing a trade. Just walk away and do something else for 5 – 10 minutes and when you come back, your perspective will have changed and you can look at your charts more objectively. Third, track your performance. By keeping a trading journal you will exactly know what you should be doing and you can take out the guesswork.

The Future – worrying about what you cannot change anyways

Traders always make decisions based on assumptions. In trading, the future is unknown and no matter how good you are, you know just as much about what is going to happen as any other trader. Trading is nothing but developing an edge that allows you to put the odds slightly in your favor.

Traders who are worried about the future often miss trades and are too scared to enter a trade even though they see all the entry criteria in front of them. Or, traders who believe that a setup is ‘too good to fail’ will put too much emphasize on that one trade and then can’t let go of a losing position.

Accepting that you don’t know what will happen next and that you have no control over the outcome is essential for a trader. Realizing that your only responsibility is to follow your rules, to work on your skills and then let the market do what it does, is one of the most important steps towards becoming a better trader.

Trading in the Now

“Trading what you see” is a very corny saying and there is much more to it. In the context of this article, it suggests that you should not let your past trading results interfere with your upcoming trades and that letting fear of potential future losses get in the way of your trading decisions is equally dangerous.

A lack of confidence is what causes amateur traders to make mistakes. If you are constantly changing systems, never really put in the work to develop a better methodology and just trade based on guessing, developing confidence is impossible. If you lack confidence, the past and the future become great influencing factors and can easily destroy your whole trading game. Thus, we urge you to stop system hopping, start focusing on one approach alone and making a commitment to make it work.

“If you are never certain about the viability of your edge, you won’t feel too confident about it. To whatever degree you lack confidence, you will experience fear.” – Mark Douglas